The changing landscape of sustainable finance

Introduction: limiting the costs of climate change and the ‘just energy transition’

Despite broad scientific consensus about the trends and causes of climate change[1], the precise timing and magnitude of risks remain uncertain. Moreover, the physical impacts of climate change may have economic implications, including threats to food security caused by extreme weather events and rising temperatures, disruption to communication and transport systems, and changes in tourism patterns. These threats pose risks to employment and human health, and may diminish a government’s fiscal space[2] by increasing the need for social safety nets and infrastructure maintenance or repair. They also pose a financial risk, for example, through potential changes in the value of financial assets, or by affecting the availability or cost of credit and liquidity.[3] Models that link climate impacts to economic outcomes are, however, fraught with difficulty – in part because of heterogenous local and regional effects that introduce uncertainty even into short- and medium-term projections.[4]

The potential physical and economic impacts of climate change need to be contained. But mitigation efforts do not come without a cost and associated risks. In South Africa, the cost of these economic transition risks has been estimated at R2 trillion.[5] The main concerns for vulnerable South Africans will be related to these transition risks, for example the impact on employment. To limit these risks, many governments (including South Africa) have outlined large green-energy investment strategies as part of their post-COVID reconstruction plans. By investing in renewable energy, they hope to boost economic recovery while aiming for more sustainable growth.

A major focus of the energy transition in South Africa is our high dependence on coal for electricity generation, which accounts for the largest source of per-capita greenhouse gas emissions. For the average South African, in 2018 electricity caused five times more greenhouse gas emissions than transport, the next biggest contributor.[6] There might be opportunities to substantially lower our emissions by greening the electricity sector. However, a socially ‘just’ energy transition means that legislation and policies are needed to protect workers whose jobs might be at risk. In addition, significant skills transfers will likely be necessary if individuals working in affected industries (such as coal mining) are to be absorbed elsewhere in the economy.

Sustainable finance and investment

Greater disclosure of potential climate and other Environmental, Social and Governance (ESG)-related risks may make it easier to balance the different objectives of a ‘just energy transition’. Activists and shareholders (including asset managers) are increasingly urging firms to take climate and other ESG criteria into account. With a view on making investments that will deliver high returns and limit risks in the long run, asset managers might encourage firms to disclose their exposure to climate related risks, or even engage more directly about best practices or a firm’s climate transition plans. The Net Zero Asset Managers Initiative, for example, is an international group of asset managers committed to supporting the goal of net-zero greenhouse gas emissions by 2050 or sooner. As of December 2021, it had 236 signatories with $57.5 trillion in assets under management. [7]

However, there are unintended consequences of these investment patterns, such as a risk of “greenwashing”, whereby firms create the false impression that their actions are more environmentally friendly than is the case. It could also result in it becoming more difficult to fund investment in fossil fuels, as evidenced by some South African banks, which have announced they will limit their exposure to fossil fuel investments. Nedbank, for instance, reports that by 2025 it will no longer provide project finance for new thermal-coal mines, and “to have 100% of [its] lending and investment activity supporting a net-zero carbon economy” by 2050.[8] However, so long as demand for fossil fuels remains high, there are likely to be investors willing to take the risk. High demand plus dwindling supply (recently worsened by the war in Ukraine) may lead to higher prices, geo-political tension, and economic and political risks. It is therefore important to prioritize innovation and investment in alternative infrastructure and technological improvements. It may also be wise to incentivize producers of fossil fuels to invest in lowering/ capturing their emissions as opposed to simply reducing output.

Local and international developments in sustainable finance

There is a growing focus on increased social responsibility and calls for greater disclosure of ESG risks, but regulatory interventions may be needed to speed up the global response. In fact, National Treasury[9] warns that “many of the transition risks [that South Africa will face] result from transitions in the global economy and cannot be prevented by any national government but require rapid adaptation by all players public and private”.

To encourage change at a global level, the Financial Stability Board (FSB) of the G20 countries has established a Task Force on Climate-related Financial Disclosures (TCFD). In 2017, the Task Force published recommendations for disclosure of climate-related risks[10], which has in many ways – despite being voluntary – become the standard for global best practice.[11]

Two other important regulatory developments in the EU have implications for South Africa. The EU Taxonomy Regulation provides a classification system for green and sustainable economic activities, aimed at preventing greenwashing of investments. The Sustainable Finance Disclosure Regulation (SFDR), introduced by the European Commission in March 2021, sets mandatory ESG disclosure obligations for financial market participants and asset managers – including South African asset-management firms that operate in EU markets. It aims to give greater consideration to ESG factors when making investment decisions, and to prevent greenwashing by improving transparency.[12]

While the US does not yet require companies to disclose information about climate risks, John Kerry (the presidential climate envoy) said in April 2021 it would soon join Europe in doing so.[13] In March 2022, the Securities and Exchange Commission (SEC) issued a draft proposal for standardised climate disclosures from public companies.[14] The SEC Chair motivated the proposal by saying it was responding to a demand from investors for consistent information about the impact of climate change on companies’ financial performance. The proposal would require public companies to report on the physical as well as the transition risks associated with climate change.[15]

In the UK, the “Green Finance Report 2017-2019” published by the House of Commons embeds sustainability into financial decision-making. Rather than turning to legislative interventions, the report recommends cooperation by government, regulators, and the private sector. In line with the above, the Bank of England (BoE) sees climate change as relevant to its mission of maintaining monetary and financial stability.[16] The UK has also announced it will start to require certain companies to include emissions and climate risks in their annual reporting.

China has begun to require its financial institutions to transition towards green finance. The People’s Bank of China (PBoC) has announced it will create incentives for financial institutions to support the transition and that it will reveal new mechanisms to encourage financing for emission cuts.[17] The PBoC acknowledges that China’s financial system will play an important role in the country’s green transition; in May 2021 it said it would collaborate with the European Union to adapt a taxonomy for green investments.[18]

Responding to these trends, National Treasury[19] published a report in 2020 on “Financing a Sustainable Economy” to address ways in which climate change may impact on financial markets. The report drew from inputs by about 50 stakeholders and looked at the voluntary practices for sustainable finance currently available in South Africa through banking, retirement funds, collective investment schemes, private equity, capital markets, and insurance. It emphasised that to achieve climate resilience, there is a need for greater disclosure and faster adoption of measures to build capacity, credibility, and consistency.[20] In line with these recommendations, a draft Green Finance Taxonomy for South Africa was released by a Taxonomy Working Group chaired by National Treasury.

These developments beg the further question about what role central banks should play in the emergence of sustainable finance and mitigating climate risks.

Should central banks help lower carbon emissions?

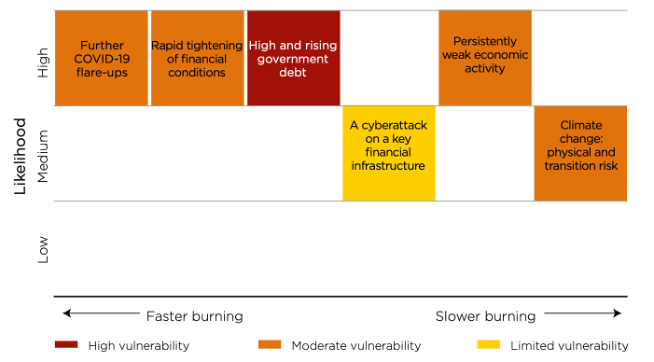

Climate change and mitigation strategies can threaten financial stability through three transmission channels: (1) direct operational risks (risks to business continuity of banks), (2) banking credit risk (if output losses or regulatory changes affect the profit margins of firms), and (3) market risks (from global supply chain disruptions, changes in consumer preferences or policies, or severe weather events that impact sovereign debt).[21] The SARB’s Financial Stability Review recognises these risks and in 2021 classified the vulnerability of the financial system to climate change as ‘moderate’ and with medium likelihood.

SARB Risk Assessment Matrix

Source: SARB Financial Stability Review 2021 (first edition)

While climate-change policies are not directly the responsibility of most central banks, as a source of financial risk the impact of climate change and measures designed to address the threat nonetheless lie within the mandate of most modern central banks. The potential uncertainty, volatility, and economic transformation posed by climate change are being identified as threats to financial institutions and financial systems.[22]

More controversial is the argument that central banks should also consider climate change in the execution of monetary policy itself. On the Bank of England (BoE) website, the central bank makes the case that the environment and the economy impact each other, and that climate change presents risks to economic activity, the productivity of the workforce, and the smooth functioning of financial markets.[23]

Recognising the need to prepare for these risks, the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) was established in December 2017. As of February 15th 2021, the network had 87 members – including the SARB. The Network ‘defines and promotes best practices to be implemented within and outside of the Membership of the NGFS and conducts or commissions analytical work on green finance’.[24] The growing engagement of central bankers with the topic of climate change has been reflected in speeches by policy makers internationally, including Christine Lagarde[25] and even the conservative Jens Weidmann.[26]

In line with other central banks, the SARB is developing new mechanisms to measure the exposure of domestic financial institutions to climate risks. It is working with banks to develop climate-related stress tests to determine the risks they face under different climate scenarios, and it asks banks to provide a high-level estimation of the level of exposure that it has to transition-sensitive assets in different sectors.

However, that the exact role of a central bank in the fight against climate change remains contentious. Otmar Issing[27] argues that ‘Tackling climate change is – and must remain – the responsibility of elected governments and parliaments.’ There is a risk that central banks are becoming ‘over-burdened’.[28] By accepting responsibility for policies for which they are not democratically accountable, there is also a risk that ‘mission creep’ will damage central bank independence and undermine the role they can play. Some central banks are incorporating climate-change considerations into their financial stability monitoring, whereas others are also considering it with respect to their monetary policy role. We do not take a position on whether concerns about over-reach are justified, but we describe the emerging position within which businesses will need to operate.

Internationally, financial regulators are requiring more climate-risk assessments.[29] In 2020 and 2021, these included climate-risk stress testing for major banks and insurers by the Bank of England, Banque de France, and De Nederlandsche Bank. The European Central Bank, Network of Central Banks and Supervisors for Greening the Financial System, the United Nations, and Basel Committee on Banking Supervision in 2020 each issued documents detailing their expectations or guidelines for financial institutions with respect to managing climate risk. In parallel, in 2020 there were calls from the Commodity Futures Trading Commission, New York State Department of Financial Services, and the SEC’s current acting chair for financial institutions to urgently incorporate climate-related risks in their assessments. This aligns with the SEC’s recent proposal for standardized climate disclosures, mentioned above.

On 3 March 2021, Rishi Sunak, the British Chancellor of the Exchequer, formally changed the mandate of the BoE to clarify that its policy should henceforth reflect the UK government’s climate and environmental objectives, including the transition of the UK financial system to net zero by 2050. For example, the BoE will be expected to scrutinise the companies from which it purchases bonds and will therefore exert further pressure on high-carbon emitters to adapt.

The formalisation of policies such as these will impact on South African institutions that wish to do business with British financial institutions and firms, because they themselves will have to report to the BoE and UK financial regulators. While South Africa might have its own goals for 2050, we will be held to higher standards through international trade and organisations.

Conclusion

There is a growing focus on the potential physical and economic effects of climate change and the implications that these might have for financial stability and investment. Mitigating or containing the effects of climate change may, however, involve transition costs that will be higher for some economies and regions than for others. Given South Africa’s high poverty levels, any costs associated with moving to a low-carbon economy should take the full range of socio-economic impacts (employment, in particular) into account.

Sustainable finance and greater disclosure of climate and other ESG-related risks is one way in which some of the economic effects of climate change might be managed. Enabling shareholders and investors to make more sustainable investment decisions may also help to minimize the impact of climate change on financial stability. It also increases transparency in aid of a ‘just energy transition’. Incorporating such recommendations into business practices – even if not yet mandatory – may lessen the risk that South African firms are cut off from other economies for not keeping up.

[1] Myers, K. F. et al. (2021) Consensus revisited: quantifying scientific agreement on climate change and climate expertise among Earth scientists 10 years later. Environmental Research Letters, Volume 16, Number 10.

[2] Arndt, C., C. Loewald and K. Makrelov (2020). Climate change and its implications for central banks in emerging and developing economies. SARB Working Paper – WP/20/04. Available online: https://www.resbank.co.za/en/home/publications/publication-detail-pages/...

[3] Federal Reserve (2021). Climate Change and Financial Stability, FEDS Notes. 19 March 2021. Available online: https://www.federalreserve.gov/econres/notes/feds-notes/climate-change-a...

[4] Federal Reserve (2021). Climate Change and Financial Stability, FEDS Notes. 19 March 2021. Available online: https://www.federalreserve.gov/econres/notes/feds-notes/climate-change-a...

[5] National Treasury (2020). Financing a sustainable economy. Technical paper.

[6] Climate Watch (2021). Available online: www.climatewatchdata.org

[7] https://www.netzeroassetmanagers.org

[8] Nedbank (2020). Nedbank Group TCFD Report 2020.

[9] National Treasury (2020). Financing a sustainable economy. Technical paper. Page 3.

[10] TCFD (2017). Recommendations of the Task Force on Climate related Financial Disclosures. Final Report. June 2017.

[11] NortonRoseFulbright (2020). Global, EU and UK sustainable finance initiatives. December 2020. Available online: https://www.nortonrosefulbright.com/en-za/knowledge/publications/a5848ad...

[12] NortonRoseFulbright (2020). Global, EU and UK sustainable finance initiatives. December 2020. Available online: https://www.nortonrosefulbright.com/en-za/knowledge/publications/a5848ad...

[13] Financial Times (2021b). US may join Europe in mandating climate risk disclosures. 21 April 2021. Available online: https://www.ft.com/content/77a8292d-2e7f-43a1-9062-2e639c1e6b2a

[14] https://www.barrons.com/articles/the-secs-climate-proposal-may-fundament...

[15] https://www.forbes.com/sites/carriemccabe/2022/03/31/the-secs-proposed-c...

[16] https://www.bankofengland.co.uk/climate-change

[17] Reuters (2021). China to require financial institutions to move towards green finance - c.bank gov. 20 April 2021. Available online: https://www.reuters.com/world/china/china-require-financial-institutions...

[18] Lexology (2021). China and EU to Collaborate on Green Investment Standards. 12 April 2021. Available online: https://www.lexology.com/library/detail.aspx?g=9031e27b-bc47-4210-b8e5-c...

[19] National Treasury (2020). Financing a sustainable economy. Technical paper.

[20] National Treasury (2020). Financing a sustainable economy. Technical paper.

[21] Arndt, C., C. Loewald and K. Makrelov (2020). Climate change and its implications for central banks in emerging and developing economies. SARB Working Paper – WP/20/04. Available online: https://www.resbank.co.za/en/home/publications/publication-detail-pages/...

[22] Rudebusch (2021). Climate Change Is a Source of Financial Risk. 8 February 2021. Federal Reserve Bank of San Francisco – Economic Letter. Available online: https://www.frbsf.org/economic-research/publications/economic-letter/202...

[23] BoE (n.d.). Climate change: why it matters to the Bank of England. Available online: https://www.bankofengland.co.uk/knowledgebank/climate-change-why-it-matt...

[24] NGFS (n.d.). Origin of the Network for Greening the Financial System. Available online: https://www.ngfs.net/en/about-us/governance/origin-and-purpose

[25] Lagarde, C. (2021). Climate change and central banking. Keynote speech by Christine Lagarde, President of the ECB, at the ILF conference on Green Banking and Green Central Banking. 25 January 2021. Available online: https://www.ecb.europa.eu/press/key/date/2021/html/ecb.sp210125~f87e826c...

[26] Weidmann, J. 2021. What role should central banks play in combating climate change? Remarks at the ILF Online-Conference “Green Banking and Green Central Banking: What are the right concepts?”, Goethe University Frankfurt, 25 January 2021. https://www.bundesbank.de/en/press/speeches/what-role-should-central-ban...

[27] Issing, O. (2019). The Problem With “Green” Monetary Policy. 2 December 2019. Project Syndicate. Available online: https://www.project-syndicate.org/commentary/central-banks-no-to-green-m...

[28] Siklos, P.L. (2017). Central Banks into the Breach: From Triumph to Crisis and the Road Ahead. New York: Oxford University Press.

[29] Rudebusch (2021). Climate Change Is a Source of Financial Risk. 8 February 2021. Federal Reserve Bank of San Francisco – Economic Letter. Available online: https://www.frbsf.org/economic-research/publications/economic-letter/202...

Download article

Post a commentary

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. To comment one must be registered and logged in.

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. Please view "Submitting a commentary" for more information.