Is South Africa heading for a fiscal crisis?

Are budget cuts the only option to reduce the deficit and cut the national debt? Or has the main economic challenge been misstated? The Institute for Economic Justice argues that the county’s main challenge is not the debt burden but growth, and that there are a number of steps National Treasury could take to raise more revenue without cutting spending that threatens development and socio-economic rights.

Introduction

In the lead-up to the Medium-Term Budget Policy Statement, the National Treasury instructed departments and provincial treasuries to put in place a slew of measures aimed at reducing spending, and in turn the budget deficit. According to the National Treasury, these cuts were necessary to restore the health of public finances. The Institute of Economic Justice investigated the claim that the country would be headed for a fiscal crisis unless deep spending cuts are made.

Undeniably, a fiscal deficit amid tougher borrowing conditions is worrying. However, the government’s continued access to capital markets, idle resources from ineffective tax rebates to the wealthy and corporations, and its contingency resources meant that the budget mismatch could have been immediately closed without budget cuts. Hence, South Africa was not, and is not, facing a fiscal crisis. Instead, the country is facing a growth and a social crisis.

While the National Treasury has acknowledged that South Africa’s challenge is growth, the Medium Term Budget Policy Statement (MTBPS) has not put forward a credible strategy on how to bring about this growth. The root cause of the growth and social crisis lies in the government’s narrow orthodox economic policy thinking. National Treasury has prioritised debt stabilisation above all else. As a result, government spending has been cut, with the claim that this will help crowd in private investment. However this has not materialised. Moreover, there has been a historical failure to create an inclusive and dynamic economy. The 2023 MTBPS continues on this unsustainable path.

In our policy brief, we discussed a range of proposals to address the current budget mismatch. These proposals should still be considered ahead of the National Budget in 2024. We propose that the government increase revenue by expanding the taxation of wealth and cutting tax breaks for high earners. Further, we recommend that the cost of borrowing be lowered through capital management techniques and debt relief. In addition, any changes to expenditure should be preceded by and informed through, a thorough and transparent spending review. Lastly, we recommend that a reorientation of fiscal policy towards social and developmental spending is necessary to address the growth and social crisis.

The extent of the revenue and expenditure shortfall

The MTBPS revenue estimate presents a slightly better picture of public finances than we had expected. Using the April to August 2023 monthly revenue collection data, we estimated a full-year revenue shortfall of R52.4 billion. In the MTBPS, the Treasury projects a lower figure of R44 billion. Data from the past six years – excluding 2020/21 – shows that the share of total revenue collected in the first four or five months has very little year-on-year variance.

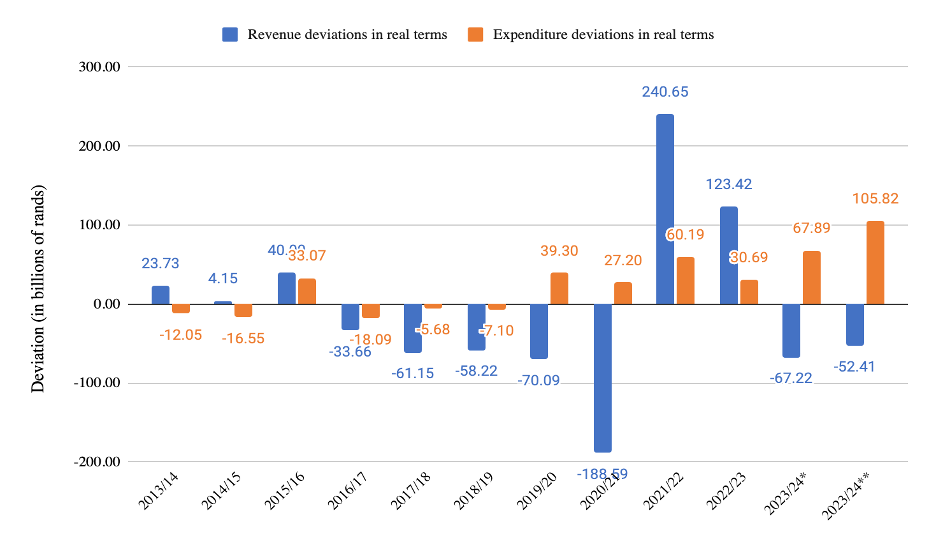

The R44 billion revenue shortfall is in line with historical norms. Figure 1 shows that in the immediate pre-Covid-19 period, 2016/17 to 2018/19, the government experienced revenue shortfalls (in real terms) in the range of R33 to R70 billion.

Figure 1: Revenue and expenditure deviations in real terms (April 2023 rands) with projections for 2023/24 made before the MTBPS (2013/14 – 2023/24)[1]

As we expected, the bulk of the revenue shortfall is driven by value-added tax refunds and the poor performance of the mining sector. The commodity prices boom, which brought about revenue surpluses in 2021/22 and 2022/23, ended in 2023. This has impacted corporate income tax revenue – where mining tax revenues contributed to 28% of collections in 2021/22 and 2022/23 – as well as mining and petroleum royalties. The largest share of the shortfall however can be attributed to higher-than-expected value-added tax refunds. According to the MTBPS, in 2023 this was driven by stronger-than-expected exports, and increased investments in embedded generation (rebates to firms and households that imported zero-rated items to cope with electricity outages).[2]

Spending cuts in the MTBPS

In line with the pre-MTBPS pronouncements made by the Finance Minister, the 2023 MTBPS proposes cuts to key expenditure. While in-year spending cuts are lower than anticipated, there is a R62 billion real-terms reduction in non-interest consolidated government spending from last year (2022/23 to 2023/24). Compared with its allocations in the 2023 February Budget, main budget non-interest spending falls by R85 billion over the next two years. This continues the failed path we have been on for almost a decade. It is both retrogressive and self-defeating.

These reductions in spending allocation will hit users of basic social services hard. Over the next three years, the government will decrease spending on every public school learner and public healthcare user. The MTBPS reports a decrease from 2022/23 to 2023/24 of real spending in health and basic education of R10 billion and R2 billion respectively. In the medium term (over the next three years), the government aims to decrease real spending on basic education and healthcare by R16 billion and R14 billion respectively. This means spending per enrolled learner will fall, in real terms, from R25 387 in 2022/23 to R23 363 in 2026/27. It also means that while each public healthcare recipient was receiving an average of R5 326 in 2022/23, by 2026/27 this will fall to R4 525 in real terms.

The National Treasury has begrudgingly allocated resources to the Social Relief of Distress (SRD) grant, albeit with a cut of R10 billion compared with the allocation in 2022. This is a perfect illustration of the backward logic of the budget framework, which puts the objective of a primary budget surplus over the immediate needs of people.[3] Whilst hunger and the depth of poverty climb, the SRD grant’s budget has steadily decreased—from R44 billion in 2022/23 to R36 billion in 2023/24 and now to R33.6 billion in the MTBPS. Whereas estimates show that up to 16 million people should be receiving the grant, the new allocation allows for only 7.5 million beneficiaries.

The extent of the budget deficit

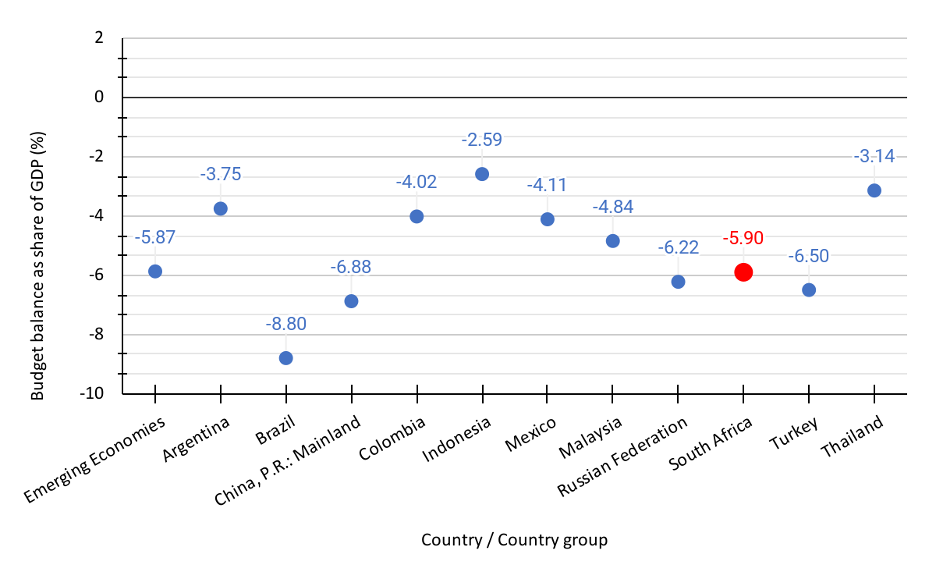

Given a lower-than-expected revenue shortfall and expenditure overrun, our budget deficit will be significantly lower than anticipated. The IEJ had estimated a main budget deficit share of GDP of 6.29%, which was slightly higher than the IMF estimate of 5.9%. Both these estimates implied that the gap between revenue and spending was at its highest since the Covid-19-riddled 2020/21. Regardless, these estimates would be in line with anticipated budget deficits from countries at a similar level of economic development, which were expected to average 5.87% in 2023/24 (see Figure 2). Instead, the National Treasury expects a budget deficit of 4.7%, which is 0.8 percentage points higher than what it anticipated in the 2023 National Budget. Moreover, this budget deficit is not significantly different from the 4.5% deficit we saw in 2022/23. This vindicates the IEJ’s assessment that the country is not facing an immediate crisis. However, as we show below, higher borrowing costs will need to be addressed to make the deficit sustainable.

Figure 2: Government deficit in major emerging economies, 2023

The role of National Treasury

The current budget mismatches were avoidable. They should be seen partly as a result of the National Treasury’s poor planning, budgeting, and in some cases deliberate omission of key expenditure items.

A bulk of the expenditure overrun is accounted for by the public-sector wage increase that amounts to R37.4 billion. The wage settlement was higher than budgeted, but this was foreseeable. Since 2021, inflation has been consistently above 5%. However, the National Treasury budgeted only 1.6% for the wage increase while the outcome was 7.6%. The same trend continues in the MTBPS where despite a forecasted inflation of 4.7% only 2% of the wage increase has been budgeted for next year. Worryingly, more than a third of the R37.4 billion that is due to public servants will be funded through a re-prioritisation of money already allocated for other departmental functions. This is likely to hurt those departments’ ability to serve the public adequately.

In addition, there were some unfunded submissions. These are key line items that departments have submitted to the National Treasury that remained unfunded. They amount to R26 billion and include R17 billion for provincial health and education in 2023/24. In addition, by 2024/25, the National Treasury reports “unfunded budget submissions” of about R80 billion.

The continuous lack of funding is informed by the Treasury’s strategy of fiscal consolidation, which entails cuts in real non-interest expenditure. The policy has also partly contributed to successive revenue shortfalls. For instance, research has shown that contractionary fiscal shocks larger than 1.5% of GDP generate a negative effect of more than 3% on GDP even after 15 years and that the decrease in GDP reaches 5.5% for fiscal contractions larger than 3%. Moreover, a study found that austerity had a drag on GDP in Greece, Ireland, Italy, and Portugal following its implementation after the Global Financial Crisis in these countries. The study concludes that “had countries in the Euro area abstained from negative fiscal shocks, the output would have been substantially higher and may have resulted in lower debt-to-GDP ratios across European nations.” For instance, in anticipation of full-year revenue shortfalls by the end of 2016/17, 2017/18, and 2018/19, the National Treasury implemented reductions to the spending ceiling and undertook repriotisation and austerity measures associated with the revenue shortfalls shown in Figure 1.

The stated aims of fiscal consolidation were to reduce government debt and deficits, “create a stable foundation for growth, ease investor concerns about South Africa, and support faster recovery and higher levels of economic growth over the long term”. However, this has not materialised. Instead, growth has been poor. Between 1996 to 2019, real growth averaged only 2.61% while the unemployment rate averaged 27.7%. Despite this, the government has proposed further cuts in the MTBPS.

South Africa has a growth problem, not a debt crisis

Contrary to the dominant view, South Africa does not have a debt problem per se. It has a growth problem along with a social crisis, as evidenced by the high unemployment rate and high levels of inequality. Thus much of the issue about the country’s unsustainable debt trajectory stems from the lack of a clear strategy to create growth.

Three key factors need to be taken into account when assessing debt and the risks associated with it. Firstly, South African borrowing so far has been on par with trends for the past few years. While South Africa has borrowed 51% of expected borrowing in the first four months of the 2023 fiscal year, borrowing in the first four months of the past eight years has been much the same – an average of 50.6% (excluding 2020/21). Secondly, the debt-to-GDP ratio of 71% for 2022/23 is comparable to the average of 69% in emerging and middle-income countries, even with a slightly higher debt-to-GDP ratio of 74.7% forecasted for 2023/24 in the MTBPS. Thirdly, South Africa borrows overwhelmingly in rands. Currently, only 11.7% of outstanding government debt is in foreign currency. This is in line with the average of 10% in the past decade and below the official benchmark of 15%. Such a low share of foreign currency debt means that we have reduced vulnerability to large fluctuations in the exchange rate. Lastly, 90% of South Africa’s debt is long-term, reducing the risk of a potential debt crisis in the short term.

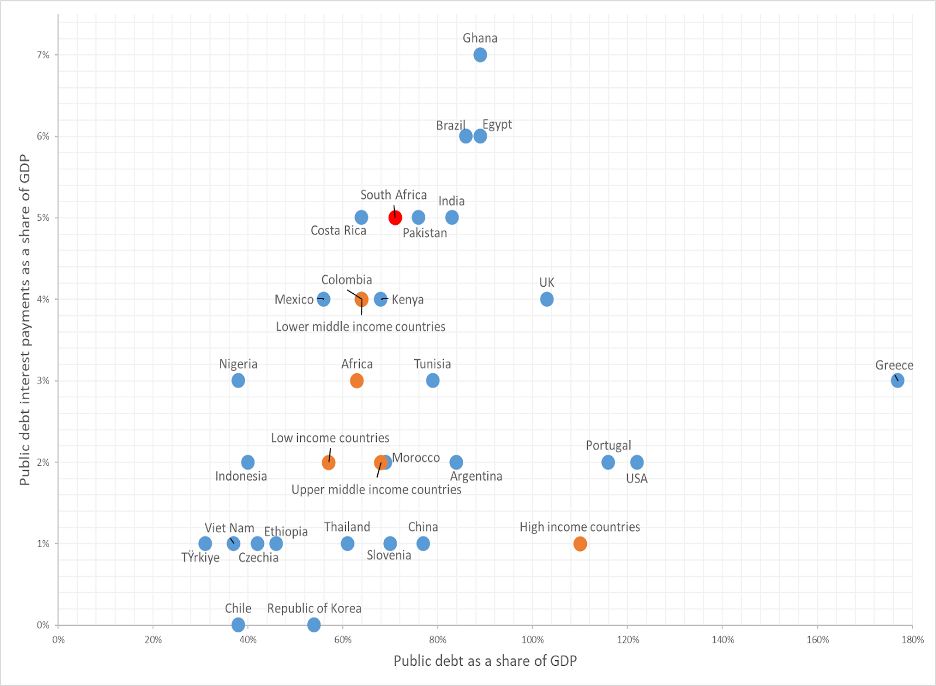

Figure 3: Debt payments as a share of GDP

These positive factors do not mean there are no concerns about South Africa’s debt. The relative size of our interest payments in particular is a major concern. For instance, compared with upper-middle-income countries, South Africa is paying 3 percentage points higher on interest payments (Figure 3). In addition, while long-term debt provides a buffer from the risk of debt default, it is more expensive, with the South African Reserve Bank raising concern that debt maturity is overly long. The interest rate on 10-year government bonds increased from 9.7% in January 2023 to 10.7% in September 2023. This has been influenced by domestic and international factors. The latter include rising inflation and interest rates in developed countries that have led to the accumulation of foreign exchange reserves, and monetary tightening. Domestically, they include the weak demand for new issuances of government bonds by non-resident investors, growing fiscal risk related to a wider-than-expected deficit, a tax revenue shortfall, state-owned company bailouts, persistent power shortages, weakening domestic growth prospects, and social instability.

Policy recommendations

Given the current state of the fiscus, the challenges of budget mismatches, and the debt trajectory, what policy options can the country pursue that will help to resolve them without compromising quality public services and long-term growth?

Some include increased borrowing, raising additional revenue, reducing expenditure, leveraging existing pools of funds, and reducing the cost of borrowing. The proposed interventions can be sequenced into three phases. That is, immediate, short-term (February 2024), and medium-term (February 2025).

Immediate measures

1. The SARB Gold and Foreign Exchange Contingency Reserve Account

An immediate measure that could be taken to close revenue and expenditure gaps is to draw from the Gold and Foreign Exchange Contingency Reserve Account (GFECR). This account is held by the Reserve Bank in terms of Section 28 of the SARB Act. The account balance represents realised and unrealised profits and/or losses made, based on movements in foreign exchange rates and gold prices. It currently has a balance of R459 billion, some of which could be used by the government to alleviate the fiscal challenges. The National Treasury can easily access these funds.

2. Increase borrowing

Another measure that can be taken is to increase borrowing. While many arguments have been levelled against more borrowing, it is important to note that the quantum of debt required to address the budget mismatch would not substantially increase our debt-to-GDP ratio. The debt-to-GDP ratio would still be 14.6 percentage points below 2021’s National Budget projection, and 3.8 percentage points below the 2021 MTBPS projection. It is important, however, that such borrowing is also used to drive structural change and improve social and employment outcomes.

Short-term measures

1. Remove tax breaks and subsidies

Additional revenue can be raised by removing tax breaks for selected high-income earners and corporations and restoring the CIT rate to 28%. In 2023, these tax breaks will cost R305 billion, and we estimate that R12 billion has already been lost from decreasing the CIT rate. There is no evidence to show that these tax breaks have increased investment or discouraged tax avoidance, as was intended. In addition to the tax cut, R6.6 billion has been lost in foregone revenue through the Employment Tax Incentive, which, much like the decrease in CIT, has no evidential basis to continue.

2. Reduce the cost of borrowing

The cost of borrowing should be reduced through yield curve management, debt renegotiation, prescribed lending, and accessing capital on more favourable terms. This includes, but is not limited to, shifting a higher share of its debt stock to medium-term bonds, renegotiating Eskom’s debt to reduce the quantum of debt owed, lowering the rates to match sovereign bonds (where they do not already), and restructuring the payment term. In addition, the SARB could also issue subsidised credit to key targeted sectors. Development finance institutions or state-owned enterprises could finance certain development projects utilising SARB-provided preferential funds. Further, credit controls can be used to finance government debt at lower interest rates. In France for instance, the government made provisions for official efforts to influence the volume, distribution, and terms of availability of credit in the French economy in 1945. These provisions included rules regarding the allocation of bank credit to various economic sectors to ensure that the allocation of credit was in line with national economic objectives.

Medium Term recommendations

1. Tax wealth

More should be done to tax wealth and the trade in financial assets. Compared with peer countries in the Organisation for Economic Co-operation and Development and Latin America, South Africa does not levy a tax on wealth and trading of financial assets. For instance, as a share of GDP, revenues from net wealth taxes have averaged 1% in Argentina since 1990, 1.98% in Colombia since 2002, 0.207% in Ecuador since 2009, and 3.5% in Uruguay since 1990.

In addition, the government should take advantage of windfalls by instituting a resource rent tax (RRT). This is a tax that can ensure that the government leverages commodity booms. In the past two years, South Africa has missed the opportunity to utilise the profits generated in the commodities sector to support revenue. DNA Economics has shown that an RRT rate of 25% could raise R38 billion, and this is not taking into account the recent commodity boom.

Conclusion

These proposals show there are alternatives to the budget cuts the Treasury deems necessary. South Africa’s current fiscal challenges are not insurmountable and can be addressed. Importantly, some of the proposed remedies could provide a stepping stone toward structural transformation that does not compromise social and economic imperatives.

[1] Source: National Treasury, various Budget Reviews, Annexure Table 2, own calculations. Note: 2023/24* refers to original calculations using April – July 2023 data; 2023/24** refers to updated calculations using April – August 2023 data.

[2] National Treasury. 2023. The Medium Term Budget Policy Statement.

[3] The objective of a primary budget surplus is so that revenue exceeds expenditure. This comes at the expense of key spending to public services and economic infrastructure, thus contributing to poor educational and health outcomes and hampers long-term economic growth.

Download article

Post a commentary

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. To comment one must be registered and logged in.

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. Please view "Submitting a commentary" for more information.