Creating jobs, reducing poverty V: Is ‘formalising’ the informal sector the answer?

Preamble

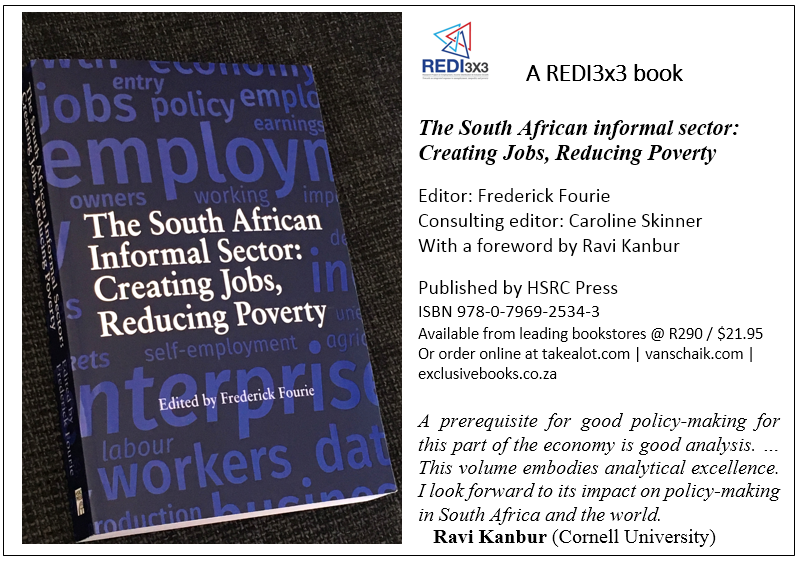

This is the fifth and final instalment of a short series of edited extracts from a new REDI3x3 book: The South African Informal Sector: Creating Jobs, Reducing Poverty. The research findings reported in the book address a significant knowledge gap in economic research and policy analysis.

The book flags the importance of explicitly addressing the informal sector in policy initiatives to boost employment and inclusive growth – and reduce poverty. Its last chapter – from which the extracts are drawn – generates a synthesis of key findings on the informal sector and develops the outlines of a proposed policy approach.

This extract considers a constructive way to approach the possible ‘formalisation’ of the informal sector, as part of a ‘smart’ policy approach to enabling the informal sector (which was discussed in the previous article). Earlier extracts presented a compact picture of the size and impact of the South African informal sector, analysed the employment-generating performance and potential of the sector, and discussed the barriers and constraints faced by informal enterprises and workers.

* More information on the book is provided at the end of this article

Introduction

Ever since the term ‘informal sector’ was first coined, ‘formalising’ the informal sector has been a constant refrain in both the academic literature and policy discourse, also in South Africa (Preston-Whyte & Rogerson 1991: 306). Recently it received new prominence due to the ILO’s Recommendation 204 concerning ‘the transition from the informal to the formal economy’ (ILO 2015). Chen notes (Chapter 2 in the book) that the 2015 ILO recommendation had a major impact on the narrative on informal-sector employment, also in South African policy circles. Indeed, the most common impulse and policy response to the ‘problem’ of the informal sector is that it should be ‘formalised’. This may be part of an uneasiness in some policy circles with informality as associated with informal employment and casual labour in the formal sector.

However, what such formalisation should entail is not always interrogated. Perhaps consequent to the noted negative connotation, in practice the concept of formalisation often tends to be reduced to regulating and taxing informal enterprises. But these are blunt instruments that amount to forced formalisation and which can be destructive. A more refined and differentiated approach is necessary.

The ILO’s Recommendation 204 and the way forward

The idea of formalising the informal economy received new impetus due to the ILO’s International Labour Conference 2014 and 2015 deliberations, resulting in Recommendation 204 (see Chen, Chapter 2 in the book). The Recommendation is built on the broad definitions of the informal economy and informal employment. Accordingly it focuses on working conditions of all informal workers and the situation of unprotected workers, with the concept of decent work and the human rights of informal workers central.

Still, it recognises that improving these conditions also requires informal enterprises to be formalised eventually and that it requires appropriate policies to facilitate such a transition and incentivise enterprises. This enterprise-based component is not always acknowledged by policy advocates who focus exclusively on employment conditions and unprotected workers.

Interestingly, though, the 2015 ILO document does not specifically use the terms ‘informal sector’ or ‘informal enterprises’ – unlike the earlier working document of the ILO (2014).[1] The 2015 document chooses to use the concept of ‘micro and small economic units’. And whilst many of the principles and measures proposed could be read to be intended for the informal sector in particular, it could equally be read as a rather general statement of policies and desirables for a modern economy and its small-business component. These include: reducing barriers to and providing incentives for the transition to the formal economy, including improved access to business services, finance, infrastructure, markets, technology, education and skills programmes, and property rights.

This drains the ILO document somewhat of weight and import with regard to the particular challenges confronting informal enterprises. Still, with respect to the formalisation of ‘micro and small economic units’ it has some useful recommendations such as that countries should simplify entrant registration, reduce tax compliance costs, promote access to public procurement, improve access to inclusive financial services, improve access to entrepreneurship training and skills development, and improve access to social security coverage (ILO 2015: 16).[2] Another group of measures relate to ensuring compliance with and enforcement of national laws and regulations regarding employment relationships, including labour inspections by enforcement bodies and strict enforcement of administrative, civil or penal sanctions provided for by national laws for non-compliance; also, ensuring that informal workers enjoy freedom of association, the right to collective bargaining and to join such organisations (ILO 2015: 17).

Unfortunately, in terms of ‘transitioning from the informal to the formal economy’, the ILO formulations are not particularly well articulated regarding the difference between what it would entail (1) for an informal-sector enterprise and (2) for workers informally employed by a formal enterprise. For the latter, an administrative–legal and compliance process may be largely what is involved. For the former, i.e. informal-sector enterprises, such a process will not attain anything. Understanding the implications of these two very different cases for policy design is absolutely essential for attaining policy clarity, effectiveness and consistency.

What role for formalisation in South Africa?

What informal enterprises need, above all, is support and enablement to survive, become stronger and, if possible, create employment, even if it is informal (at least initially). The question is how, or whether, formalisation can assist in this regard. Chen notes (Chapter 2 in the book) that formalisation is typically understood in either of two ways. First, to some observers it means shifting people out of informal self-employment and wage employment into formal wage jobs. But in many countries, and South Africa in particular, not enough jobs are created for the unemployed, much less for those employed in the informal sector as well.

Secondly, as noted above, to many policy-makers formalisation means to register and tax informal enterprises. However, informal enterprises already pay VAT (value added tax) on inputs that they purchase from formal-sector firms – without even being able to claim refunds. In addition, many pay local-government licence fees or similar. If owners don’t pay income tax, it could simply be that they earn below the income-tax threshold.[3] Tax registration would not make much difference to their daily existence or viability. A related interpretation focuses on the regulation and compliance of the informal sector, notably through licensing and the control of trading and business spaces (via zoning). This can easily be destructive if the overriding goal of the relevant authority is to obtain compliance or revenue. (The history of the treatment and eviction of street traders in urban areas in Johannesburg, Cape Town and Durban is testament to this; see Skinner, Chapter 16 in the book.)

None of these interpretations of formalisation seems very relevant for strengthening the South African informal sector or helping to alleviate the unemployment problem. As stated by the ILO:

Formalisation may sometimes be narrowly conceived only in terms of registration and punitive sanctions for non-compliance with the law. Such an approach is likely to be counter-productive, as it does not take into account the many avenues towards formalisation, the limited choices facing most informal economy actors or the range of incentives which can encourage a genuine movement out of informality (ILO 2014: 35).

Philip (Chapter 12 in the book) notes that, for the majority of informal enterprises whose market is restricted to low-income consumers in townships already served well by formal-sector goods and companies, formalising them would do little to change these competitive realities. Typically it would add costs without any equivalent benefit.[4]

A developmental approach to formalisation: Towards a formalisation menu

In the previous article it was argued that a key element of enablement is to adopt a developmental approach to informal enterprise policy. We suggested, as an overarching consideration for policy, broadly seeing informal enterprises as situated on a developmental spectrum from embryonic to mature states, with different aspirations, degrees of development, complexity and capacity – and different needs and challenges. Supporting policies must serve the full spectrum, with clearly differentiated and targeted policies.

This suggests that a matching developmental approach to formalisation may be fruitful. A first implication is that formalisation as such should not be seen as a policy goal or policy achievement. It must be seen as a means to aid the quest for better livelihoods for more people and for stronger, more self-reliant informal enterprises. Formalisation should not focus on controlling and regulating but on enabling and supporting enterprises.

Secondly, several of the enabling measures may require an element of registration or licensing – ‘a bit of formalisation’ – for an enterprise or its owner to qualify for access to that support. Such support could include, for example, getting access to suitable premises in good locations; services such as water and electricity; training in basic bookkeeping; financial services such as banking, credit and loans for asset finance, and business insurance; cyclical ‘bridging finance’ measures; government subsidies; skills development regarding strategy, management, employment practices and contracts; assistance with regard to public-sector procurement systems or formal-sector supply chains, etc.

The associated bits of formalisation could be seen as elements, or steps, of an enabling formalisation process.[5] How this unfolds and plays out will vary across enterprises. Different owner-operators will require different elements at various times, according to the enterprise’s state of development, needs, circumstances, opportunities and aspirations.

-

One can envisage a formalisation menu comprising support elements with matching elements of formalisation. Enterprise owner-operators can then select elements of formalisation as needed at a particular point in time – rather than being subject to a regime of compliance and control.

-

If the utilisation of these elements brings benefits and better business outcomes, enterprises are likely to be incentivised to continue along the developmental and formalisation trajectory – voluntarily.

Another way to conceptualise such a range of formalisation elements is in concentric circles, where the most basic enabling measures are in the centre, and more advanced measures progressively available in outer circles.

From this analysis it is clear that brute or enforced formalisation is not the way to go. Smart, nuanced formalisation is. Various degrees of formalisation can and should coexist among the spectrum of informal enterprises. Hence our preference that policy-makers should rather allow enterprise owners to self-identify and accordingly take part in, or make use of, appropriate policy instruments or formalisation elements (with eligibility criteria as applicable[6]). This would also allow a wider range of measures and considerations than those typically included in standard formalisation approaches such as that of the ILO.

* Here one must note the publication in 2014 of the NIBUS (National Informal Business Upliftment Strategy) (DTI 2014), the first ever national policy on informal enterprise (see Skinner, chapter 16 in the book). It was developed in the DTI and subsequently transferred to the new Department of Small Business Development (DSBD). While the NIBUS document (DTI 2014: 27) in fact indicates the formalisation of increasing numbers of informal businesses as a strategic objective, one must appreciate that the DSBD’s subsequent NIBUS Strategic Implementation Roadmap does not use the term ‘formalisation’. Instead, it describes an upliftment, transitioning and graduation process in which informal businesses realise the benefits of transitioning to higher levels and eventually becoming formal SMMEs (DSBD & ILO 2016: 3). How and whether this Roadmap is being implemented, is not clear at the moment, though.

Conclusion: Formalisation within the broader policy context

Given the high levels of unemployment and poverty, an informal sector with more dynamic, viable, self-reliant informal enterprises and more, better-quality employment is an important objective for South Africa. The appropriate policy objective is not to shrink or eliminate the informal sector, but to enable and strengthen it. This will probably need, and involve, selected elements of ‘smart’ formalisation: as the sector develops and grows, a growing portion of the enterprises is likely to adopt more and more elements of formalisation.

But there will always be enterprises across the spectrum from embryonic to mature, whether one- or multi-person – at various stages of entry, survival, development, profitability, capital strength and sophistication, and with different aspirations, growth-orientation and entrepreneurial aptitudes. The policy framework must cater for the entire developmental spectrum and make a range of appropriate support available.

This means formalisation should be only one component of a broad enabling policy framework for informal enterprises, in which at least three types of policy measures can be put forward:

1. Cross-cutting, generic measures regarding general support and enablement, the regulative framework, property, infrastructure, facilities, foundational business and accounting skills, access to finance, and so forth.

2. Tailored measures to support certain goals or groups, for example employing firms, one-person enterprises (own-account workers) or new entrants.

3. Industry-specific measures: giving teeth and substance to integrating the informal and the formal components of an industry or supply chain, which implies industry-specific analyses and policy projects.

All such measures must be economically informed, that is, based on an understanding of how the prospects of informal-sector businesses are critically shaped by where and how they fit into value chains and the structure of the economy. To this one can add that spatial realities are not going to go away soon – and they impact all three types of measures above. The same is true of gender realities and the vulnerable position of women in particular – a perennial issue in informal-sector analysis and policy.

An institutional challenge is how and where the three levels (or spheres) of government should be involved in these types of policy measures. The appropriate level of government needs to be capacitated and funded, taking into account an area’s general status with regard to urbanisation, informal settlements, level of development and poverty.

A general requirement is that policy-makers should explicitly take account of the informal sector in ‘other’ policies such as macroeconomic policy, trade and industrial policy, competition policy, agricultural policy and land reform, infrastructure provision, city and transport planning, labour and minimum-wage legislation and social protection.

Lastly: if we are serious about the pursuit of inclusive growth, informal-sector concerns should not feature solely in initiatives to regulate traders in townships and city centres, or be relegated to a small directorate in a small-business department. The informal sector is and must be an integral part of the response to the problems of unemployment, poverty and inequality. This means the informal sector must be taken seriously and addressed explicitly and properly. Otherwise it will simply remain the forgotten sector – and so will the people working in it.

* * *

Download from HSRC Open Access:

https://www.hsrcpress.ac.za/books/the-south-african-informal-sector-providing-jobs-reducing-poverty

References

The edited extracts are from:

Fourie FCvN (2018) Enabling the forgotten sector: Informal-sector realities, policy approaches and formalisation in South Africa. Chapter 17 in Fourie FCvN (ed) The South African Informal Sector: Creating Jobs, Reducing Poverty. HSRC Press, Cape Town.

Referenced chapters, by number:

2. The South African informal sector in international comparative perspective: Theories, data and policies – Martha Chen

3. The informal sector in sub-Saharan Africa: A comparative perspective – Katharina Grabrucker, Michael Grimm & François Roubaud

12. Limiting opportunities in the informal sector: The impact of the structure of the South African economy – Kate Philip

16. Informal-sector policy and legislation in South Africa: Repression, omission and ambiguity – Caroline Skinner

Other references:

DTI (Department of Trade and Industry) (2014) The National Informal Business Upliftment Strategy (NIBUS). Policy memo. Pretoria: DTI

DSBD (Department of Small Business Development) & ILO (International Labour Office) (2016) Provincial and Local Level Roadmap to give effect to the National Informal Business Upliftment Strategy. Policy Memo. Pretoria: DSBD

ILO (International Labour Organisation) (2014) Transitioning from the informal to the formal economy. Report No. V(1), International Labour Conference, 103rd session 2014. Geneva: ILO

ILO (2015) Recommendation concerning the transition from the informal to the formal economy. Recommendation 204. International Labour Conference. Geneva: ILO

Preston-Whyte E & Rogerson C (1991) South Africa’s informal economy. Cape Town: Oxford University Press.

[1] One should keep in mind that the Resolution 204 document is a compromise or consensus resolution between various constituencies (business, labour and government) and member countries at the International Labour Conference. From an analytical and research perspective, the earlier ILO document is a much better resource regarding policy ideas.

[2] Chen (Chapter 2 in the book) says, with regard to Recommendation 204, that the ILO’s 2015 approach to formalisation ‘suggests a more inclusionary approach: one that recognises and supports informal enterprises in the informal sector, rather than simply trying to register and tax them’.

[3] In 2017 the threshold for compulsory registration of an enterprise for VAT was an annual turnover of R1 million. For personal income tax the annual taxable income threshold was R75 750 – more than three times the median earnings of self-employed persons in the informal sector. (Average exchange rate in 2017: US$1 = R13.50). See http://www.sars.gov.za/TaxTypes/PIT/Pages/default.aspx (accessed 12 November 2017).

[4] Formalisation may well be of use to those informal enterprises capable of accessing more sophisticated, higher-value formal markets or industry-specific value chains, though such access primarily requires a step-change in terms of business and product sophistication.

[5] The NIBUS ‘Vuvuzela Graduation Model’ shows three pre-formal categories, or phases, of informal business, using the following terms: ‘survivalist informal enterprises’, ‘emerging informal enterprises’ and ‘micro-entrepreneurs’ (DSBD & ILO 2016: 4).

[6] The sustainability of a policy initiative is at risk if it indiscriminately allocates support to all enterprise owners irrespective of personal or enterprise capacity and other pertinent considerations. Such an approach may produce an ineffective and unaffordable policy and cause it to be shut down.

Download article

Post a commentary

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. To comment one must be registered and logged in.

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. Please view "Submitting a commentary" for more information.