Part 4: Fiscal dimensions of South Africa's crisis

This is the last in a four-part series by Michael Sachs, extracted from his paper, Fiscal Dimensions of South Africa’s Crisis (the full paper can be found on http://www.wits.ac.za/scis). In the last article, he examined the extent and nature of South Africa’s debt burden, distinguishing between the level of debt and its trajectory in relation to economic growth. He argued that SA’s debt was not only an impediment to economic growth, but that it also risked undermining the progressive nature of SA’s tax system. In this article, he reviews his main arguments and examines possible avenues out of the fiscal trap.

The depth of the crisis: what can be done?

Introduction: An overview

Two decades ago, South Africa was confident about its economic future. Public expenditure expanded to deliver on social objectives that had been deferred at the outset of the democratic transition. It included a permanent expansion of core public services (basic education, health and policing), an increase in pro-poor fiscal transfers, significant real improvements in the remuneration of public employees and a surge in public infrastructure investment.

Over the same period (between 2002 and 2012), taxes were lowered in the belief that economic growth would obviate the need for large sacrifices in return for these improvements. The same assumption informed the expansive policy framework mandated in the NDP. But the path of economic growth shifted then to a permanently lower trajectory, mainly because of shifts in the global economy. An historic surge in South Africa’s terms of trade had fed into economic growth and financing conditions, making the fiscal position appear sustainable. But as China began to decelerate, the commodity price upswing dissipated and South Africa’s economic expansion stalled. Even if South Africa had avoided electricity supply constraints or resisted the rising tide of corruption, these shifts would still have implied slowing growth and the need for significant adjustments to South Africa’s policy framework.

But by then the domestic policy and governance landscape had changed. The ANC’s 2007 Polokwane conference signalled the fragmentation of political power and a shift of policy authority from constitutional structures of government to opaque and diffuse processes within the ANC. Government committed itself to further expansions of public services but did not agree on a fiscal programme to support these aspirations. As in the past, it was assumed that a revival in economic growth would generate the necessary resources without the need to raise taxes. But growth continued to slow and instead of facing up to the resulting contradiction, fiscal obligations were extended even as the capacity of the state was eroded and the flow of tax revenue dwindled. Although domestic constraints – including electricity supply and the disruption of government – were initially of secondary importance, they culminated in a second blow to economic growth after 2015. Macroeconomic policy tightened, export performance worsened, and private (and then public) investment collapsed in the face of incoherent policy, regulatory capture, and intensifying fiscal crisis.

Over seven lean years of slowing growth between 2012 and 2019 South Africa contained public expenditure, keeping it at a stable share of national income. But, in Lesetja Kganyago’s[1] words, “aggregate spending […] failed to decline as a share of GDP”. This should not be surprising. From the Constitution to the NDP, the idea of a rising floor of social provision, backed by secular improvements in South Africa’s economic fortunes, have been deeply embedded in policy designs. The social consequences of retrogression are so ghastly to contemplate that South Africa has convinced itself that economic progress is the only possibility. Yet it failed to chart a path of sustained economic expansion, and income per capita began to fall after 2011. National income is not the measure of all value, but as it falls the quality of life – and the real value of public consumption – is sure to follow.

Fiscal distress

A decade of expenditure containment has already degraded the quality of public services. Budgets for national and provincial departments were strictly controlled, but costs continued to rise, and so spending on capital and the procurement of goods and services was driven down to extract fiscal space. Moderate improvements in the salaries of public servants outpaced the growth of compensation budgets, forcing a reduction in employment of teachers, nurses, police officers, and the administrators that support these core public services. The real value of health, basic education, and public security has been falling for some time. While these dynamics worsened the social crisis – directly through falling levels of employment and indirectly by eroding the consumption basket of the poor – the budget deficit has remained entrenched. Containment of social budgets has been fully offset by the rise of interest payments leading to an entrenched budget deficit. There was austerity without consolidation.

Although spending was constrained in national and provincial departments, public consumption continued to increase through local government and public agencies beyond the direct control of budget authorities. Until 2016, public infrastructure spending leveraged off the balance sheets of state companies remained buoyant. But the quality of public investments deteriorated so severely that large additional subsidies were required to keep public utilities afloat. Meanwhile, government continued to widen the scope of its fiscal commitments: New social programmes were agreed, including free university education, and these added to the pressure on core public services.

At first, government made progress towards fiscal sustainability, notwithstanding the increase in debt. Despite the slowdown in growth, private earnings at the affluent end of the labour market continued to grow faster than the economy, leading to buoyant tax revenue. In the face of a seemingly inexorable decline in economic fortunes – and after the second blow to growth in 2015 – tax buoyancy finally succumbed, and fiscal consolidation went into reverse.

In the aftermath of Covid-19, the fiscal position is profoundly unsustainable. Growth rates are below interest rates and (in these conditions) the primary balance needed to stabilise debt is not feasible. As Blanchard et al (2020) point out “there are economic and political limits to how large a primary surplus a government can generate. When debt service requires a primary surplus that exceeds this limit […] debt will explode.” If fiscal imbalances are not resolved, the burden of interest payments will quickly become intolerable, making the future ability and willingness of the state to honour its obligations questionable. South Africa is entering a period of fiscal distress.

The crisis cannot be resolved solely by fiscal consolidation, and the path of consolidation proposed by government is so extreme that it is neither possible nor desirable. The attempt at large fiscal adjustment would impose unsustainable social pressures and choke off the recovery, adding to the shock to livelihoods imposed by the Covid-19 catastrophe.

Can the Reserve Bank bailout Treasury?

In this unenviable context, it is natural to look for innovative alternatives. Some hope that by inflating the value of rand-denominated assets (including sovereign debt), the central bank can avert the fiscal crisis and restore the momentum of growth. Such a path is fraught with danger. Short-term support to prevent the collapse of the bond market might continue, and this will ease the fiscal constraint to some degree. If global monetary conditions remain easy, it will be possible to build on the SARB’s credibility, extending bond purchases and other support.

The balance sheet of central banks has long been a core policy instrument, with a clear relation to the structure and conditions for sovereign debt management.[2] As an instrument, bond purchases are always on the table, and governments across the world have stepped up these operations over the past two years. The questions relate to the purpose and extent of the operation. As to the purpose, the central banks of middle-income countries have been virtually unanimous in declaring the objective as “restore[ing] stability and liquidity in the bond market”.[3] The SARB followed the same script in the bond market crisis of April 2020, buying bonds to ensure market stability and committing to doing so again if necessary. In the wake of this intervention, Governor Lesetja Kganyago said:

‘We continue to monitor the government bond market and to buy bonds where we observe signs of stress at different maturities of the yield curve. This will continue as needed to restore normal market functioning. Up to now, it appears our interventions have worked. Volatility has subsided, and bond yields have largely normalised. While we are not targeting yields specifically, the fact that the benchmark 10-year yield is back to where it was in February suggests that stress in the system has eased.’[4]

Although the rhetoric is the same everywhere, the extent and design of these interventions vary widely. Some emerging markets are clearly attempting to ease a government’s borrowing constraint, but in South Africa bond purchases have been limited and the central bank has argued explicitly that it “cannot take responsibility for solving a fiscal sustainability problem”.[5]

The policy question can be viewed in two ways. First, to what extent might the balance sheet of the central bank absorb financial liabilities created in the wake of the Covid-19 shock with a view to unwinding these liabilities at a future date? Second, can South Africa rely on its monetary sovereignty to hold down the interest rates that government pays on its debt, thereby ameliorating the ghastly rise in debt service costs and avoiding a crisis of debt sustainability? In my view, the first is possible[6], but the second is not.

Through its April 2020 actions, the SARB accepted its role as “buyer of last resort” for sovereign bonds. The intervention lowered bond yields[7] and so lessened the fiscal constraint. Several observers suggest that, while global monetary conditions remain supportive, there is scope for more aggressive interventions.[8]

In my view, the SARB can and should continue to bring stability to the bond market and in so doing they will (whether they like it or not) ease government’s borrowing constraint. But the idea that central bank balance sheet operations can lower South Africa’s sovereign interest rate or offset the pressures for a correction to fiscal imbalances on a sustained basis, appears doubtful to me.

When the central banks of the US, UK, and Europe announce large expansions in bond purchase programmes, or other means of effectively monetising the deficit, they “crowd in” private market participants. Their currencies strengthen, and their financing conditions ease on global markets. Until now, middle-income countries have been similarly successful and, in motivating an even more aggressive approach, Benigno el al stress the “surprisingly favourable investor reaction” to emerging market bond purchases and the importance of central bank credibility in sustaining these operations.

But these responses have been differentiated. In South Africa’s case, investor confidence was very fragile in the aftermath of the Covid-19 crisis. By and large, the USA, UK, and European economies saw exchange rate appreciation and falling bond yields. The same pattern can be observed in several emerging markets, including those that have implemented strong bond buying programmes. Through the course of 2020, South Africa faced a large exchange rate depreciation and a substantial increase in bond yields. In the midst of crisis, market participants did not regard South Africa as a safe port in the storm. Why might this be the case?

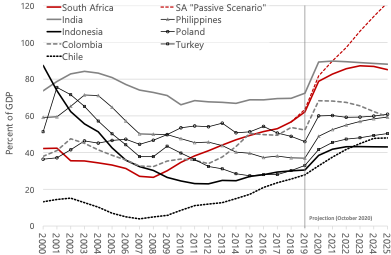

One factor that distinguishes South Africa is the extent of its fiscal crisis, indicated by an unstable debt path. Figure 1 shows the debt path of several middle-income countries with extensive bond purchase programmes. Of these, only South Africa’s debt is unstable, raising question marks about when (or if) it will stabilise, and what policy responses are likely to emerge in the face of debt distress.[9] More aggressive bond purchases by the central bank may improve matters in the short term, as “some bondholders would probably be enthusiastic about a large bond purchase programme so they could dump their bonds on the SARB and minimise their losses”.[10]

But over time, the central bank is unlikely to be able to stabilise the value of sovereign assets, by absorbing a significant fraction onto its balance sheet, when the solvency of the sovereign is doubted. In order to conduct extensive unconventional monetary policy operations, the treasury needs to function as a backstop against potential losses that the central bank may face on its balance sheet.[11] As concerns about sovereign insolvency mount, the balance sheet of the central bank is also placed in doubt, eroding the SARB’s credibility and authority.

In this case, overly aggressive action by the central bank may increase, rather than diminish, the risk that rand-denominated financial assets will be subject to sudden crises of confidence and destructive depreciation in value. This is because they may well feed perceptions that that the state intends to act in a manner that would renege on its debt obligations.

The SARB alone cannot resolve the structural imbalances in South Africa’s public finances. South Africa is a small, vulnerable, fiscally unsustainable economy on the periphery of global capitalism with five years of declining per-capita output behind it, and an uncertain path ahead. It is a price-taker on the value of its sovereign liabilities, including its money and government debt. An attempt to resolve the fiscal imbalance by, for instance, monetising the deficit would invite financial disorder, worsening both the current crisis and South Africa’s future growth prospects.

Compulsory financing?

All governments raise compulsory revenues through taxation, whereas the cash garnered from debt issuance is ordinarily based on voluntary exchange. But government is both the largest borrower in most nations and the regulator of debt markets, a position that enables it to tilt property rights in its own favour.[12]

The Second World War debts of Britain and the United States were not paid down by reducing expenditure. Instead, primary surpluses were achieved with high rates of taxation, complemented by inflation and various forms of compulsory financing or “financial repression”.[13] This included “directed lending to government by captive domestic audiences (such as pension funds), explicit or implicit caps on interest rates, regulation of cross-border capital movements, and (generally) a tighter connection between government and banks”. Similar means were employed in Japan and later the fast-growing Asian developmental states.

Post-war compulsory financing took place in a context of closed capital markets, an effective social compact, a capable state and the fastest pace of economic growth in recorded history. Policy action held interest rates low, while growth was rapid. Today low interest rates are the natural consequence of “secular stagnation” and policy action must face globalised financial markets and broken social compacts. If the current easing of monetary conditions is not followed with a revival in the pace of growth in the developed world, further global financial turmoil is likely to follow.

Figure 1: Debt-to-GDP ratios in selected emerging markets with bond purchase programmes

|

Source: IMF World Economic Outlook (October 2020), IHSMarkit Note: Estimates start after 2018 |

In South Africa, compulsory financing has been suggested in several forms, including asset prescription on pension funds, an expansion of the state banking sector, and various proposals for monetary easing and directed credit on the part of the central bank and development finance institutions. If South Africa were to go down this path, these or similar measures would be unlikely to succeed without a different approach to the regulation of the capital market. The current situation – where South Africa’s capital markets are strongly integrated and regulated with a light touch, and where South Africa is both an investor in overseas capital markets and reliant on foreign savings – is not compatible with the coercive direction of national savings behind public policy goals.

Achieving the transformation of macroeconomic institutions to create conditions in which compulsory financing might work is not impossible. But it would be an exceedingly bold strategy under the best of conditions, given the strength of South Africa’s financial sector. In the face of stagnating economic growth and ballooning public debt, it is likely to intensify rather than alleviate the macroeconomic crisis that South Africa faces.

Public infrastructure investment

Government believes growth can be revived through a renewed commitment to public infrastructure investment.

Without action to restore the regulatory, policy, and institutional weaknesses that have debilitated the public sector, this approach is unlikely to succeed. Achieving these reforms on the other hand will take time and political effort. In the short term then, the inertia blocking a resumption of growth can only be overcome with private investment in the lead. This will require policy commitments that back a stream of profit that is large, credible, and long-lived enough to justify the upfront commitment of significant private resources. Such a move is unlikely to be popular, but the alternative is to allocate an even larger volume of public resources as guaranteed income to private capital in the form of debt-service costs, in exchange for a pipeline of state-mediated mega-projects.

Conclusion

The first decade of South African democracy was underpinned by an implicit bargain. Private property rights would be protected in return for the redistribution of assets and ownership, and access to incomes through public sector employment and provision.[14] But the redistribution of assets, whether through land reform, housing policy or black economic empowerment, has not been successful. In its stead, greater reliance has been placed on the redistribution of income.

South Africa has been held together (just) by an implicit fiscal bargain that has two dimensions. First, high levels of taxation strongly concentrated on affluent households have financed social grants, universal access to basic education and healthcare, RDP houses, free basic water and electricity, real pay gains for public servants, and a rising distribution of rent to the middle strata. All of this has sustained the income levels of the vast majority. Second, collective goods – pensions, education, healthcare, security and infrastructure – are delivered privately to the affluent minority through segregated systems of provision financed by fees, insurance premia, and user charges.

Fiscal crisis will force changes in all these structures. The pace and distribution of the adjustment needs to be engaged, but the fiscal framework will have to change one way or another. If South Africa succeeds in raising its rate of economic growth it might stabilise debt but will be left with a huge burden of debt servicing – income sent overseas or redistributed to affluent households through interest payments. This debt overhang implies a significant rise in the general rate of taxation (redistributing income away from taxpayers). Without it, the debt cannot be serviced. Tax increases will need to be focussed on the most affluent and corporate capital, but there will also be implications for the middle strata. At the same time, the consumption of collective goods will be reduced to a level more consistent with South Africa’s waning economic fortunes. The poor and lower middle class depend to a large degree on public consumption to sustain their living standards (whereas the affluent are protected in segregated systems), and the current contestation about public sector salaries are a first indication of a struggle to determine who will bear the brunt of this adjustment.

Since the 1970s, South Africa’s macroeconomic fortunes have waxed and waned behind large swings in the commodity cycle and global financial conditions. The basic parameters of fiscal sustainability – interest rates and the rate of growth – are to a large extent determined by these external conditions. As is the case in any democratic society, political realities constrain the primary balance needed to stabilise debt. Debt is now unsustainable because growth is low, the interest rate is too high, and the primary balance needed to prevent a debt explosion is not politically feasible.

Several policy conclusions might be offered about fiscal and macroeconomic policymaking in South Africa arising from the foregoing analysis. First, the resolution of the fiscal crisis depends on faster economic growth, which will need to be led by private investment. Fiscal consolidation is necessary but debt will not stabilise without growth. Second, even if growth accelerates, the current structure of the public economy will have to change. This is likely to entail increased levels of taxation and reductions in public consumption.

Lastly, the institutions of macro policy coordination should be reconsidered with a view to a stronger focus on managing adjustments to long-lived shifts in external conditions, rather than short-term fluctuations around a domestic business cycle.

References

Arslan, Yavuz, Mathias Drehmann, and Boris Hofmann. 2020. ‘Central Bank Bond Purchases in Emerging Market Economies’. BIS Bulletin 20:9.

Bartsch, Elga, Agnes Benassy-Quere, Giancarlo Corsetti, and Xavier Debrun. 2020. It’s All in the Mix: How Monetary and Fiscal Policies Can Work or Fail Together. Centre for Economic Policy Research.

Benigno, Gianluca, Jon Hartley, Alicia Garcia-Herrero, Alessandro Rebucci, and Elina Ribakova. 2020. ‘Credible Emerging Market Central Banks Could Embrace Quantitative Easing to Fight COVID-19’. CEPR Policy Portal, July 6.

Betz, Timm, and Amy Pond. 2020. Governments as Borrowers and Regulators. Working Paper available from http://people. tamu. edu/∼ apond/research. html.

du Plessis, Stan: A stone under the ocean; How money did not disappear and what we need to do about it: Bienniam SARB Conference proceedings, 2012

Gelb, Stephen. 2004. ‘An Overview of the South African Economy’. in The State of the Nation (2004-2005). HSRC Press.

Kganyago, Lesetja. 2020a. ‘Opening Address at the Fourth Annual Distributed Sovereign Debt Research and Management Conference’.

Kganyago, Lesetja. 2020b. ‘The SARB the Coronavirus Shock and the Age of Magic Money’. in Lecture at the Wits School of Governance.

Nagy-Mohacsi, Piroska. 2020. ‘The Quiet Revolution in Emerging-Market Monetary Policy’. Project Syndicate, August 18.

Reinhardt, Carmen M., and M. Belen Sbrancia. 2011. ‘The Liquidation of Government Debt.Pdf’. BIS Working Papers (363).

Sachs, Michael. 2020a. Macro-Fiscal Considerations in Response to the COVID-19 Crisis. Covid19 Economy Group.

[1] Kganyago, L (2020) a

[2] The SARB itself acted as “market maker” in the creation of South Africa’s secondary bond market (Kganyago 2020a:8; du Plessis 2012)

[3] Arslan et al 2020. Indonesia the only country cited in Arslan et al explicitly states the purpose of bond buying to be “to assist the government finance the handling of the COVID-19 impact on financial system stability if the market is unable to fully absorb the [bonds] issued by the Government”

[4] Kganyago, L, 2020 (b)

[5] Ibid

[6] See Sachs, 2020 a

[7] Arslan et al, 2020

[8] Benigno et al, 2020; Nagi-Mohacsi et al, 2020

[9] Interestingly, Chile – the only country that might be construed to have a debt path like South Africa’s – has eschewed the purchase of government bonds. Its bond purchase programme is reserved for private sector corporate bonds.

[10] Kganyago, L, 2020b

[11] Bartsch et al, 2020

[12] Betz and Pond, 2020

[13] Reinhardt et al, 2011

[14] Gelb, S, 2004

Download article

Post a commentary

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. To comment one must be registered and logged in.

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. Please view "Submitting a commentary" for more information.