Why SA needs to boost exports

Introduction

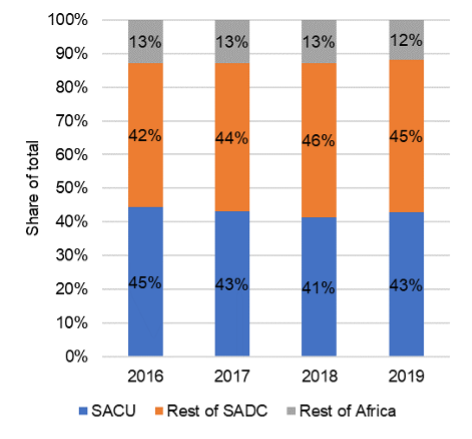

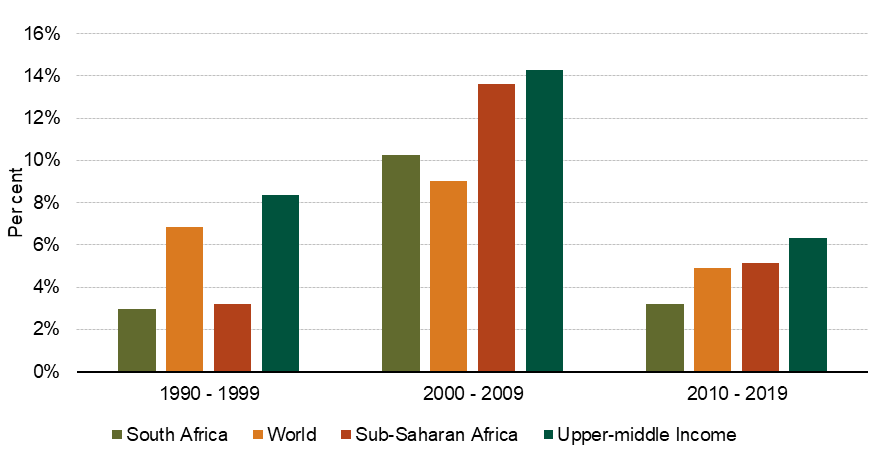

South Africa relies heavily on imports to satisfy consumption demand and on exports to support production and employment. As the country’s economic growth accelerated from 1990 to 2008, so too did trade increase as a proportion of gross domestic product (GDP). However, between 2010 and 2019, its export growth rate decreased by more than half. Moreover, exports have grown at a much slower pace than the rest of the world, and the country has underperformed against middle-income and sub-Saharan comparators, as shown in Figure 1.

Figure 1: Nominal export growth rate

Source: World Bank (2020), ‘Exports of goods and services (annual % growth) – South Africa, world, upper middle income’.

Exports clearly have a part to play in raising South Africa’s overall growth performance. What, then, explains South Africa’s lethargic trade growth over recent years and what can be done to restore export growth?

Reasons for South Africa’s weak trade performance

Slowing trade reforms

In the years leading up to and following South Africa’s re-integration into the global economy in the early 1990s, the government made numerous efforts to reform its domestic trade administration processes and advance its multilateral, bilateral, and regional trade interests. These initiatives contributed to deeper trade relations and increased openness in the South African economy.[i] But over the past decade, there has been a notable slowdown in trade reforms, and no movement in negotiations with external trading partners outside of Africa. This is partly as a result of failures at the multilateral level, but also seems to reflect a more conservative approach from South Africa.

The exchange rate

A second factor that may explain changes in South Africa’s exports is the performance of the rand. A currency depreciation would make goods produced in South Africa cheaper compared with our trading partners, and should boost exports. On the other hand, a stronger currency may harm export competitiveness. In assessing the impact of the currency’s movement on trade performance, it is important to consider changes in prices within countries, as these may offset currency fluctuations. For this reason, the real effective exchange rate (REER) should provide the best measure of the impact of the rand on South Africa’s international competitiveness.

Over the past three decades, the REER has trended downwards, thereby boosting South Africa’s international competitiveness. However, there is no obvious correlation between changes in the REER and export growth. For example, a sharp depreciation of the REER in 2001 and 2002 did not lead to a positive export response; conversely, when the REER appreciated from 2003 to 2005, export volumes increased. Likewise, the REER has depreciated for most of the last decade, but export growth has remained slow. The extent to which the depreciation of the real value of the rand stimulates export growth is therefore unclear.[ii]

Geographic and product concentration

South Africa’s export performance may be a function of its trade profile. If exports are concentrated among a group of slow-growing markets, then this would hamper South Africa’s ability to expand its international sales. In 2001, South Africa’s export market was dominated by the United States (US) (14%), the United Kingdom (UK) (10.9%), Germany (9.1%), and Japan (8.9%). By 2019, the US share had dropped to 7%, the UK to 5.2%, and Japan to 4.8%. Germany’s share remained relatively consistent at 8.3%.

In comparison, China’s share of South Africa’s exports increased from 1.8% in 2001 to 10.7% in 2019, while exports to the rest of Africa increased from 15.5% to 26.7%. A similar trend can be seen when analysing South Africa’s main import markets: the EU remains the dominant supplier of goods to South Africa, at around 30% of the total, though China’s share has increased from 4% to 19% over this period.

It would seem that, in general, South African exporters did well to diversify out of the relatively mature European and US markets into the fast-growing Chinese market and the emerging African market. However, from 2013 onwards, this trend has slowly reversed. South Africa appears to be losing some of its foothold in China and Africa, with exports to Europe increasing in importance. Over this same period, South Africa’s exports have declined sharply as a percentage of world exports and as a percentage of domestic GDP.

South Africa’s export growth rate is also likely linked to the structure of trade and specifically the kind of goods that South Africa produces competitively and exports. In 2001, South Africa’s top 10 export products were coal, motor vehicles, platinum, oil, gas-filtering machinery, palladium, diamonds, aluminium, platinum and ferro-chromium. Together, these accounted for 37% of South Africa’s total exports. By 2019, the top 10 exported goods were coal, gold, iron ore, motor vehicles, manganese ore, oil, ferro-chromium, platinum, and palladium, making up 36% of South Africa’s world exports.[iii]

With the exception of machinery in 2001, and motor vehicles in both 2001 and 2019, South Africa’s exports are strongly and consistently concentrated in mineral and metal products. From 2001 to 2018, the share of raw materials in South Africa’s overall export basket has increased at the expense of beneficiated or intermediate goods, while exports of consumer and capital goods have remained relatively static. However, the fact that South Africa’s export basket is loaded with primary goods is not sufficient to explain the country’s overall poor export performance.

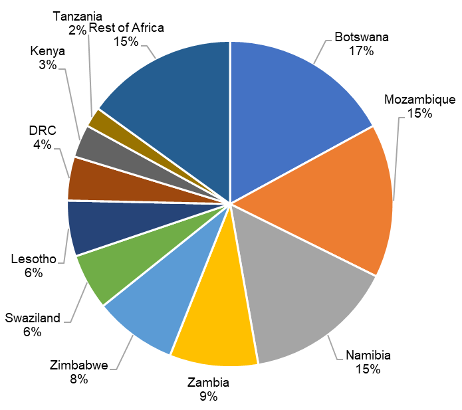

Trade with Africa

While South Africa’s global export performance has been disappointing and is dominated by commodity products, there is a perception that export growth into Africa has been strong and much more diversified. However, as shown in Figure 2, South Africa’s exports to Africa are highly concentrated in the Southern African Customs Union (SACU) and a few neighbouring markets.

|

Figure 2a: SA exports to Africa by region

|

Figure 2b: SA’s top 10 export markets in Africa, 2019

|

Source: Based on data from SARS

The available data from the South African Revenue Service indicate that at least 8% of South Africa’s exports to SACU do not originate in South Africa. A more detailed analysis of the structure of trade, between South Africa and its neighbours, suggests that this percentage is likely to be substantially higher. It would therefore seem that a large part of South Africa’s apparent manufacturing export success in southern Africa is actually due to the country’s success in logistics, wholesale and retail services. This may also explain the low use of tariff preferences by South African exporters in the region.

The deteriorating enabling environment

South Africa’s international competitiveness is strongly influenced by a wide range of structural and environmental factors that affect the costs of production and trade. These include skills and labour-market issues, access to well-priced and high-quality electricity and communications inputs, and the efficiency and cost of the logistics system.

The World Bank’s Ease of Doing Business Survey provides a perspective of South Africa’s relative competitiveness across a wide range of dimensions: the country has fallen 52 positions in the ranking in just 11 years. A major cause of this decline is high trading costs – where South Africa was ranked 145th out of 190 countries in 2019 – and, specifically, border compliance costs. Similarly, in the World Economic Forum (WEF) Global Competitiveness Report, South Africa has fallen from 42nd (of 117 countries) in 2005 to 60th (of 141 countries) in 2019. According to the WEF, South Africa was ranked 77th in trade openness and 69th in trade infrastructure.

In our paper, we also examine South Africa’s approach to international trade negotiations, drawing on interviews with several trade policy experts and officials, and the potential impact of industrial policy on export performance. In both cases, South Africa’s policy priorities do not appear to support its recent export performance and its future trade prospects.

Policy recommendations

To address the apparent bias against exporting that has arisen in South Africa, four sets of remedial actions are recommended.

First, South Africa urgently needs to address the high cost of investment and trading across borders, and reverse its relative decline in international competitiveness. This will require a concerted and well-coordinated effort to improve rail and port efficiencies; streamline customs, registration, licensing and other administrative processes; lower the costs and improve the quality of critical inputs, such as telecoms, energy and transport; and remove or reduce regulatory impediments to the movement of goods, services and skills into the country.

Second, South Africa should review the impact of its existing industrial, localisation and sector-specific policies on export behaviour. Whereas the existing policy framework strongly supports the transformation and industrialisation of the domestic economy, in some instances this may come at the cost of the country’s long-term international competitiveness. National policies may also have adverse effects on South Africa’s partners in the region.[iv] These trade-offs need to be identified and evaluated, and, where possible, mitigating actions need to be put in place.

Third, to offset some of these costs and overcome the challenges of entering new markets, a comprehensive and targeted export promotion and export finance framework is required. The available international evidence suggests that export promotion agencies are important in addressing information asymmetries, which are typically larger for smaller firms and differentiated products, and when firms try to enter new country or product markets. Moreover, bundled support services – including counselling for new exporters, missions and fairs, and the development of business relationships – are more effective than any isolated actions.[v] Likewise, there is a role for government to ensure that exporters have access to world-class financial products and services, including export credit and insurance.

Fourth, an updated and comprehensive trade policy is needed to guide South Africa’s approach to trade support and negotiations across Africa and internationally; to develop consistent positions on newer trade issues, such as services and e-commerce; to consider the impact of changed international conditions, such as climate change, and the emergence of global value chains; and to promote serious trade facilitation reforms at and beyond the country’s borders. This policy should be founded on substantive research that considers the impact of existing policies and institutions on export performance; identifies target markets and priority products and services; and analyses the costs and benefits of alternative policy instruments and options. It should be informed by widespread consultations across government and with business, labour and civil society. The resulting policy should incorporate a detailed monitoring and evaluation framework so that progress can be measured, problems can be identified, and corrections made. The country’s trade policy should also be reviewed and revised more regularly.

[i] Malefane, M R. 2018. ‘Trade openness and economic growth: experience from three SACU countries’. Doctoral dissertation, University of South Africa, Pretoria. SARB. 2000. Annual economic report. Pretoria: SARB.

[ii] Edwards, L and Schoer, V. 2001. ‘The structure and competitiveness of South African trade’. TIPS Annual Forum 10–12.

[iii] ITC TradeMap. 2020. ‘Data sources for all countries and territories’.

[iv] Stakeholder interviews.

[v] Cadot, O, Fernandes, A, Gourdon, J and Mattoo, A. 2011. ‘Where to spend the next million? Applying impact evaluation to trade assistance’. Washington, D.C.: World Bank.

Download article

Post a commentary

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. To comment one must be registered and logged in.

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. Please view "Submitting a commentary" for more information.